Potato Power

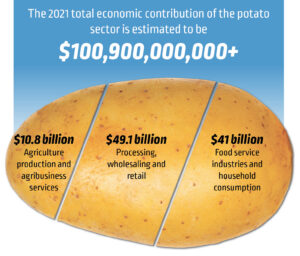

A recent report highlighting the potato industry’s $100.9 billion economic impact in the U.S. featured eye-catching numbers, and the timing of its release was no accident.

Funded by the National Potato Council and authored by Michigan State economists, “Measuring the Economic Significance of the U.S. Potato Industry” was released Feb. 28. That was just in time to get its findings in front of decision makers at the 2023 NPC Washington Summit, Feb. 27-March 3 in Washington, D.C.

“The timing of the report was very intentional,” Kam Quarles, CEO for NPC, told Spudman. “The first question that any policymaker is going to ask when you walk in the door is, ‘Who are you and what’s the value in me helping you?’ They might not say it to you, but in their minds, they’re thinking that.

“I think this economic report clearly defines how significant the potato industry is for the U.S. overall, and that appropriate policies, if they get stood up, are going to make those numbers bigger in the future.”

The message of the report, which also found that the potato industry generates an estimated 714,000 domestic jobs with annual wages of $34.1 billion, seems to have reached its target audience. U.S. Secretary of Agriculture Tom Vilsak cited its data when meeting with NPC representatives, Quarles said.

“Not only are potatoes an essential and healthy component in our diet, but now we can say unequivocally that they are vital to the American economy,” RJ Andrus, president of the National Potato Council, said in a news release announcing the report findings.

The industry’s total economic impact includes $10.8 billion in agriculture production and agribusiness services, as well as $49.1 billion in processing, wholesaling and retail. Another $41 billion is contributed through food service industries and household consumption.

“We knew it was an incredibly broad industry with a lot of impact across the U.S., but the $100 billion number, when you look at the entirety of the supply chain, was impressive to us,” Quarles said.

As substantial as the statistics are, potatoes — the number one vegetable consumed annually in the U.S. — can’t rest on the roots of that success. The industry faces several pivotal policy battles in 2023 and beyond.

DEFINITION DEBATE

One looming concern for the potato industry is a fight for its very identity. As the process of writing the 2025-2030 Dietary Guidelines for Americans begins, Quarles said NPC is again hearing a drumbeat from some who want potatoes reclassified from starchy potatoes to a grain. Potatoes have historically faced nutritional criticism for being high in the type of carbohydrate that the body digests rapidly, causing blood sugar and insulin to surge and then dip — which can result in a feeling of hunger soon after eating.

“We obviously don’t have a lot of excitement about such a proposal. We think it’s preposterous on its face,” Quarles said. “But these are the type of initiatives that the federal government, from time to time, will throw at us, and it’s our responsibility to push back.”

The stakes, Quarles said, are much higher than mere nomenclature or public perception. If potatoes were no longer classified as a vegetable, he said, they would no longer be considered a specialty crop and therefore ineligible for programs such as the U.S. Department of Agriculture’s Specialty Crop Research Initiative and Specialty Crop Block Grant Program as well as Farm Bill initiatives.

“All of a sudden we would be bounced out of those programs,” he said. “The cascading negative effects of this are really far-reaching.”

COVID ECHOES

The potato industry, like most in the U.S. and the world, is still dealing with the ramifications of the COVID-19 pandemic and ongoing supply chain snarls that have contributed to an expected shortage.

An Organic Produce Network report from late February forecasts a 5% dip in all potato sectors from the previous year, while crop insurer ProAg warned potato growers in December 2022 that they may need to get creative to stretch volumes throughout the season after a harvest of just more than 900,000 acres — down from 935,700 in 2021.

“We’re still dealing with echoes from the COVID lockdowns,” Quarles said. “You’ve got to have fertilizer, pesticides in certain instances. All of those essential inputs have been in some way challenged over the past few years, and if you don’t get them in the right spot when it’s time to plant, necessarily, that’s going to impact what your overall numbers are.”

Fertilizer availability has been further complicated by the ongoingwar in Ukraine, a global leader in fertilizer production (exports to the U.S. alone totaled $632.7 million in 2021). And even if growers can find a needed input, they may struggle to pay for it.

“Initially, you had problems just simply of availability,” Quarles said. “Now it’s a challenge of price. You’ve got inflation kicking in. You can get your hands on it, but you may be paying 100% more or 200% more. Those will cause certain if not all growers to make choices. “Everybody’s doing the math in their head about what kind of return can I be getting, and they’re making the most appropriate cost-benefit decisions in real time.”

WORKFORCE WOES

Labor issues, always present in agriculture, have been exacerbated by the pandemic. In November 2022, the U.S. Department of Labor adopted a final rule to amend the H-2A visa program, which allows U.S. employers who meet specific requirements to bring foreign nationals to the U.S.

The changes attempt to address employment standards and conditions and modernize the processing of job orders and certification applications, among other reforms, but Quarles said program problems persist.

“It’s very cumbersome. It doesn’t respond to the immediate needs of the marketplace,” he said. “It asks growers to irrationally forecast their labor needs months in advance, when you simply don’t know what Mother Nature is going to throw at you. And then it also operates with a mandatory elevated minimum wage that the federal government sets every single year in a different place.

Often that wage can explode right in the middle of a producer’s season and makes it incredibly hard to budget.”

Quarles advocates a threefold overhaul: a provision of legal status for current migrant workers; a reformed or reimagined guest worker program; and strong enforcement of any new regulations.

SUSTAINING MOMENTUM

Other potato priorities include trade policy and pest and disease control.

“We’ve got to have access to new, valuable foreign markets,” said Quarles, whose organization is currently pushing for access to the Japanese market for fresh U.S. potato exports and focused on keeping the Mexican market open.

Keeping the potato wart plaguing Prince Edward Island, which caused a border closure in 2021 and resulted in the destruction of hundreds of millions of pounds of seed and table potatoes in the Canadian province, from the U.S. is also a paramount concern.

“If potato wart were able to get established in a production area, it would change the U.S. potato industry overnight in a materially negative way,” Quarles said. “It would impact both interstate commerce as well as compromise all of our export markets.”

While sounding an optimistic note about the potato industry’s future and lauding the impact codified by the NPC-commissioned report, Quarles said work remains to be done.

“It’s been an incredible amount of amazing work by all of these growers and other members of the industry to get to this place, but no one should rest on this,” he said. “We’ve got a lot of challenges out there. We’ve got some great opportunities, too. In terms of consumer demand, in terms of new production capacity that’s being brought online by some very significant players both domestically and internationally, there are some great tailwinds out there for the potato industry. But we cannot get complacent.”